assets_testdata <- read.csv(system.file("testdata", "assets_testdata.csv", package = "trisk.model"))

scenarios_testdata <- read.csv(system.file("testdata", "scenarios_testdata.csv", package = "trisk.model"))

financial_features_testdata <- read.csv(system.file("testdata", "financial_features_testdata.csv", package = "trisk.model"))

ngfs_carbon_price_testdata <- read.csv(system.file("testdata", "ngfs_carbon_price_testdata.csv", package = "trisk.model"))Sensitivity Analysis

Vary parameters over entire dataset

Sensitivity analysis allows us to explore how changes in parameters affect the results. In this example, we show how to vary the shock year in multiple TRISK runs when defining run parameters for sensitivity analysis.

run_params <- list(

list(

scenario_geography = "Global",

baseline_scenario = "NGFS2023GCAM_CP",

target_scenario = "NGFS2023GCAM_NZ2050",

shock_year = 2030 # SHOCK YEAR 1

),

list(

scenario_geography = "Global",

baseline_scenario = "NGFS2023GCAM_CP",

target_scenario = "NGFS2023GCAM_NZ2050",

shock_year = 2025 # SHOCK YEAR 2

)

)The function run_trisk_sa() is used to run a sensitivity

analysis with Trisk:

sensitivity_analysis_results <- run_trisk_sa(

assets_data = assets_testdata,

scenarios_data = scenarios_testdata,

financial_data = financial_features_testdata,

carbon_data = ngfs_carbon_price_testdata,

run_params = run_params

)

#> [1] "Starting the execution of 2 total runs"

#> -- Retyping Dataframes.

#> -- Processing Assets and Scenarios.

#> -- Transforming to Trisk model input.

#> -- Calculating baseline, target, and shock trajectories.

#> -- Calculating net profits.

#> Joining with `by = join_by(asset_id, company_id, sector, technology)`

#> -- Calculating market risk.

#> -- Calculating credit risk.

#> [1] "Done 1 / 2 total runs"

#> -- Retyping Dataframes.

#> -- Processing Assets and Scenarios.

#> -- Transforming to Trisk model input.

#> -- Calculating baseline, target, and shock trajectories.

#> -- Calculating net profits.

#> Joining with `by = join_by(asset_id, company_id, sector, technology)`

#> -- Calculating market risk.

#> -- Calculating credit risk.

#> [1] "Done 2 / 2 total runs"

#> [1] "All runs completed."Contrary to a simple run of trisk with the “run_trisk_model” function, here it is possible to navigate through multiple Trisk runs in the same dataframe, using the run_id column as an index.

Consolidated NPV results

| run_id | company_id | asset_id | company_name | asset_name | sector | technology | country_iso2 | net_present_value_baseline | net_present_value_shock | net_present_value_difference | net_present_value_change |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | 101 | Company 1 | Company 1 | Oil&Gas | Gas | DE | 192983.3 | 3.381424e+04 | -159169 | -0.8247815 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 102 | 102 | Company 2 | Company 2 | Coal | Coal | DE | 49678081.7 | 1.169635e+07 | -37981727 | -0.7645570 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 103 | 103 | Company 3 | Company 3 | Oil&Gas | Gas | DE | 106853461.1 | 3.661307e+07 | -70240391 | -0.6573525 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 104 | 104 | Company 4 | Company 4 | Power | RenewablesCap | DE | 1063402907.7 | 1.413116e+09 | 349713309 | 0.3288625 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 105 | 105 | Company 5 | Company 5 | Power | CoalCap | DE | 198507128.1 | 3.420557e+07 | -164301556 | -0.8276859 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 105 | 105 | Company 5 | Company 5 | Power | OilCap | DE | 23748004.0 | 3.751928e+06 | -19996076 | -0.8420108 |

Consolidated PD results

| run_id | company_id | company_name | sector | term | pd_baseline | pd_shock |

|---|---|---|---|---|---|---|

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | Oil&Gas | 1 | 0.0000000 | 0.0005908 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | Oil&Gas | 2 | 0.0000000 | 0.0120293 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | Oil&Gas | 3 | 0.0000011 | 0.0350054 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | Oil&Gas | 4 | 0.0000237 | 0.0614358 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | Oil&Gas | 5 | 0.0001502 | 0.0874772 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 102 | Company 2 | Coal | 1 | 0.0000000 | 0.0001410 |

Consolidated company trajectories

| run_id | asset_id | asset_name | company_id | company_name | country_iso2 | sector | technology | year | production_plan_company_technology | production_baseline_scenario | production_target_scenario | production_shock_scenario | pd | net_profit_margin | debt_equity_ratio | volatility | scenario_price_baseline | price_shock_scenario | net_profits_baseline_scenario | net_profits_shock_scenario | discounted_net_profits_baseline_scenario | discounted_net_profits_shock_scenario |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | 101 | Company 1 | DE | Oil&Gas | Gas | 2022 | 5000 | 5000 | 5000.000 | 5000 | 0.0056224 | 0.0763542 | 0.1297317 | 0.259323 | 5.867116 | 5.867116 | 2239.895 | 2239.895 | 2239.895 | 2239.895 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | 101 | Company 1 | DE | Oil&Gas | Gas | 2023 | 5423 | 5423 | 5001.354 | 5423 | 0.0056224 | 0.0763542 | 0.1297317 | 0.259323 | 5.898569 | 5.898569 | 2442.414 | 2442.414 | 2282.630 | 2282.630 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | 101 | Company 1 | DE | Oil&Gas | Gas | 2024 | 6200 | 6200 | 5002.708 | 6200 | 0.0056224 | 0.0763542 | 0.1297317 | 0.259323 | 5.930022 | 5.930022 | 2807.250 | 2807.250 | 2451.961 | 2451.961 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | 101 | Company 1 | DE | Oil&Gas | Gas | 2025 | 7400 | 7400 | 5004.062 | 7400 | 0.0056224 | 0.0763542 | 0.1297317 | 0.259323 | 5.961475 | 5.961475 | 3368.360 | 3368.360 | 2749.585 | 2749.585 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | 101 | Company 1 | DE | Oil&Gas | Gas | 2026 | 7800 | 7800 | 4862.620 | 7800 | 0.0056224 | 0.0763542 | 0.1297317 | 0.259323 | 5.945170 | 5.945170 | 3540.723 | 3540.723 | 2701.201 | 2701.201 |

| 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 | 101 | Company 1 | 101 | Company 1 | DE | Oil&Gas | Gas | 2027 | 8600 | 8600 | 4721.178 | 8600 | 0.0056224 | 0.0763542 | 0.1297317 | 0.259323 | 5.928866 | 5.928866 | 3893.168 | 3893.168 | 2775.775 | 2775.775 |

Consolidated params dataframe

| baseline_scenario | target_scenario | scenario_geography | carbon_price_model | risk_free_rate | discount_rate | growth_rate | div_netprofit_prop_coef | shock_year | market_passthrough | run_id |

|---|---|---|---|---|---|---|---|---|---|---|

| NGFS2023GCAM_CP | NGFS2023GCAM_NZ2050 | Global | no_carbon_tax | 0.02 | 0.07 | 0.03 | 1 | 2030 | 0 | 9b6ffb58-57c3-4481-9e37-8e7088fa95f0 |

| NGFS2023GCAM_CP | NGFS2023GCAM_NZ2050 | Global | no_carbon_tax | 0.02 | 0.07 | 0.03 | 1 | 2025 | 0 | aae3ac96-50d0-4a68-9ed8-e32cb937da1c |

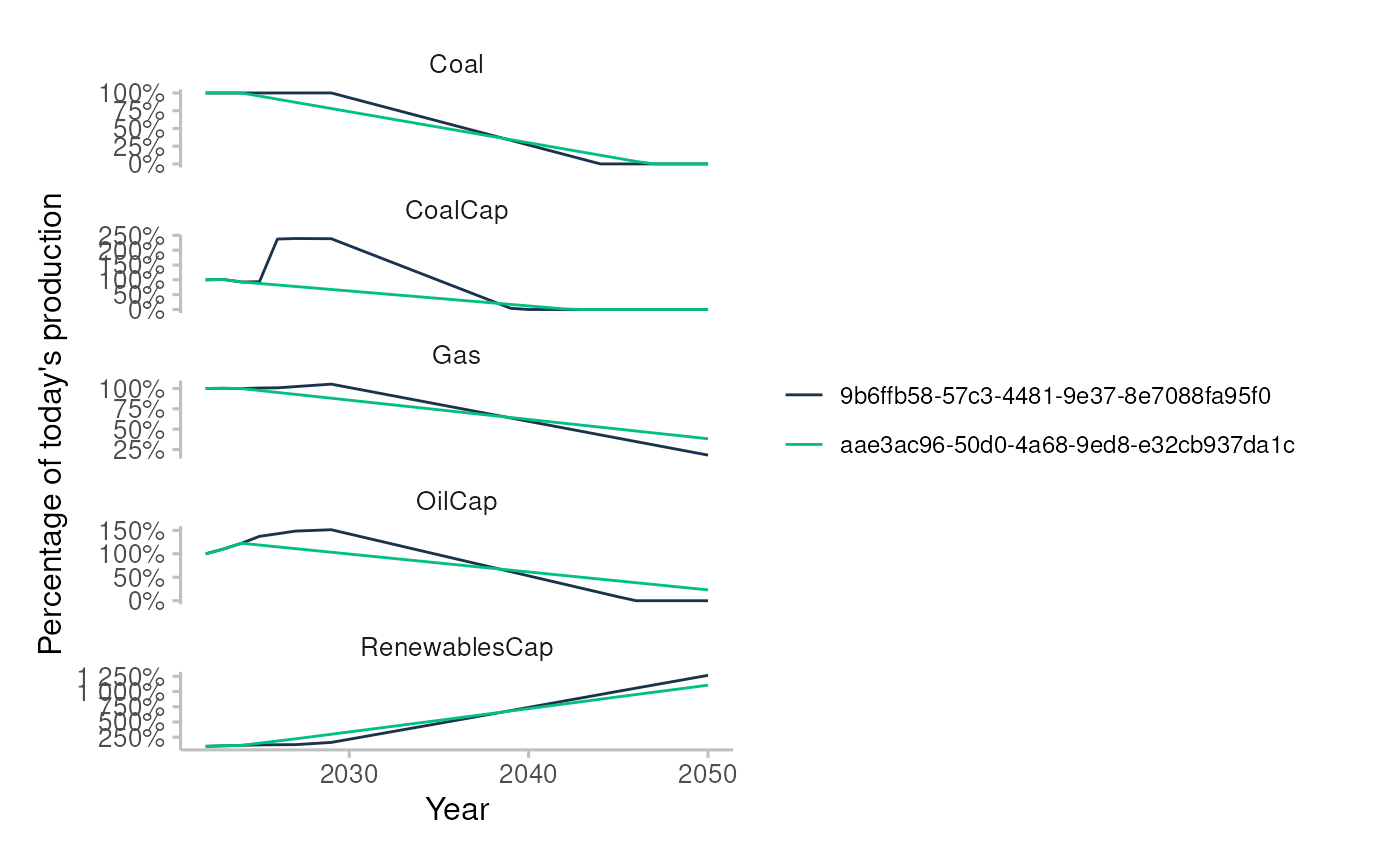

Plot results

Plot the sum of production trajectories, scaled in percentage of the first year value. The run_id identifies each run and can be found in the parameters dataframe.

plot_multi_trajectories(sensitivity_analysis_results$trajectories)

Vary parameters over a single or a group of countries

You can also perform sensitivity analysis on a filtered subset of assets. This example filters the dataset by country, and then runs the analysis.

# Run sensitivity analysis across multiple TRISK runs

sensitivity_analysis_results <- run_trisk_sa(

assets_data = assets_testdata,

scenarios_data = scenarios_testdata,

financial_data = financial_features_testdata,

carbon_data = ngfs_carbon_price_testdata,

run_params = run_params,

country_iso2 = c("DE") # FILTER ASSETS ON COUNTRIES

)

#> [1] "Starting the execution of 2 total runs"

#> -- Retyping Dataframes.

#> -- Processing Assets and Scenarios.

#> -- Transforming to Trisk model input.

#> -- Calculating baseline, target, and shock trajectories.

#> -- Calculating net profits.

#> Joining with `by = join_by(asset_id, company_id, sector, technology)`

#> -- Calculating market risk.

#> -- Calculating credit risk.

#> [1] "Done 1 / 2 total runs"

#> -- Retyping Dataframes.

#> -- Processing Assets and Scenarios.

#> -- Transforming to Trisk model input.

#> -- Calculating baseline, target, and shock trajectories.

#> -- Calculating net profits.

#> Joining with `by = join_by(asset_id, company_id, sector, technology)`

#> -- Calculating market risk.

#> -- Calculating credit risk.

#> [1] "Done 2 / 2 total runs"

#> [1] "All runs completed."