apply-stress-test-on-portfolio

Source:vignettes/apply-stress-test-on-portfolio.Rmd

apply-stress-test-on-portfolio.RmdObtain outputs

Load the test data

Load the internal datasets

assets_testdata <- read.csv(system.file("testdata", "assets_testdata.csv", package = "trisk.model", mustWork = TRUE))

scenarios_testdata <- read.csv(system.file("testdata", "scenarios_testdata.csv", package = "trisk.model", mustWork = TRUE))

financial_features_testdata <- read.csv(system.file("testdata", "financial_features_testdata.csv", package = "trisk.model", mustWork = TRUE))

ngfs_carbon_price_testdata <- read.csv(system.file("testdata", "ngfs_carbon_price_testdata.csv", package = "trisk.model", mustWork = TRUE))Define the scenarios to use

baseline_scenario <- "NGFS2023GCAM_CP"

target_scenario <- "NGFS2023GCAM_NZ2050"

scenario_geography <- "Global"Generate outputs

Run the model with the provided data, after filtering assets on those available in the portfolio.

Prepare portfolio

portfolio_testdata <- read.csv(system.file("testdata", "portfolio_testdata.csv", package = "trisk.analysis"))Sample portfolio content (columns structure to reproduce):

knitr::kable(portfolio_testdata) %>%

kableExtra::kable_styling(bootstrap_options = c("striped", "hover", "condensed")) %>%

kableExtra::scroll_box(width = "100%", height = "400px")| company_id | company_name | sector | technology | country_iso2 | exposure_value_usd | term | loss_given_default |

|---|---|---|---|---|---|---|---|

| NA | Company 1 | Oil&Gas | Gas | DE | 1839267 | 3 | 0.7 |

| NA | Comany 2 | Coal | Coal | DE | 6227364 | 1 | 0.7 |

| NA | Corony 3 | Oil&Gas | Gas | DE | 3728364 | 5 | 0.5 |

| NA | Compan 4 | Power | RenewablesCap | DE | 9263702 | 7 | 0.4 |

Run trisk

analysis_data <- run_trisk_on_portfolio(

assets_data = assets_testdata,

scenarios_data = scenarios_testdata,

financial_data = financial_features_testdata,

carbon_data = ngfs_carbon_price_testdata,

portfolio_data = portfolio_testdata,

baseline_scenario = baseline_scenario,

target_scenario = target_scenario,

scenario_geography = scenario_geography

)

#> -- Fuzzy matching assets to portfolio-- Start Trisk-- Processing Assets and Scenarios.

#> -- Transforming to Trisk model input.

#> -- Calculating baseline, target, and shock trajectories.

#> -- Calculating net profits.

#> -- Calculating market risk.

#> -- Calculating credit risk.Result dataframe :

knitr::kable(analysis_data) %>%

kableExtra::kable_styling(bootstrap_options = c("striped", "hover", "condensed")) %>%

kableExtra::scroll_box(width = "200%", height = "400px")| company_name | sector | technology | country_iso2 | exposure_value_usd | term | loss_given_default | normalized_distance | company_id | run_id | asset_id | asset_name | net_present_value_baseline | net_present_value_shock | pd_baseline | pd_shock |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company 1 | Oil&Gas | Gas | DE | 1839267 | 3 | 0.7 | 0.0000000 | 101 | 509d40ef-30de-4710-8696-47f7071c442c | 101 | Company 1 | 172718.3 | 13549.28 | 1.1e-06 | 0.1680445 |

| Comany 2 | Coal | Coal | DE | 6227364 | 1 | 0.7 | 0.1111111 | 102 | 509d40ef-30de-4710-8696-47f7071c442c | 102 | Company 2 | 42299475.0 | 4317747.56 | 0.0e+00 | 0.0197957 |

| Corony 3 | Oil&Gas | Gas | DE | 3728364 | 5 | 0.5 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Compan 4 | Power | RenewablesCap | DE | 9263702 | 7 | 0.4 | 0.1111111 | 104 | NA | NA | NA | NA | NA | NA | NA |

Plot results

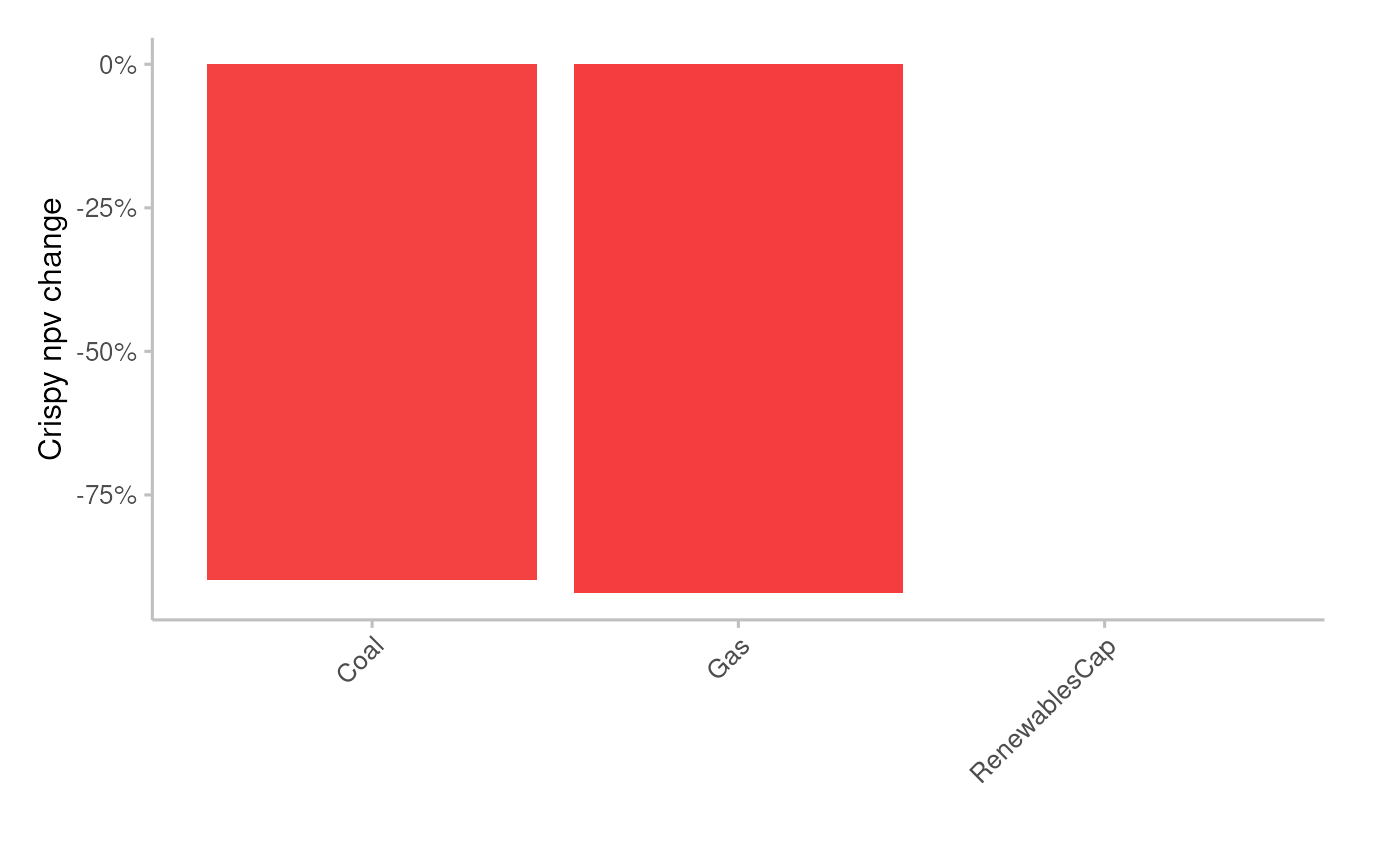

Equities risk

Plot the average percentage of NPV change per technology

pipeline_crispy_npv_change_plot(analysis_data)

#> Joining with `by = join_by(sector, technology)`

#> Warning: Removed 1 row containing missing values or values outside the scale range

#> (`geom_col()`).

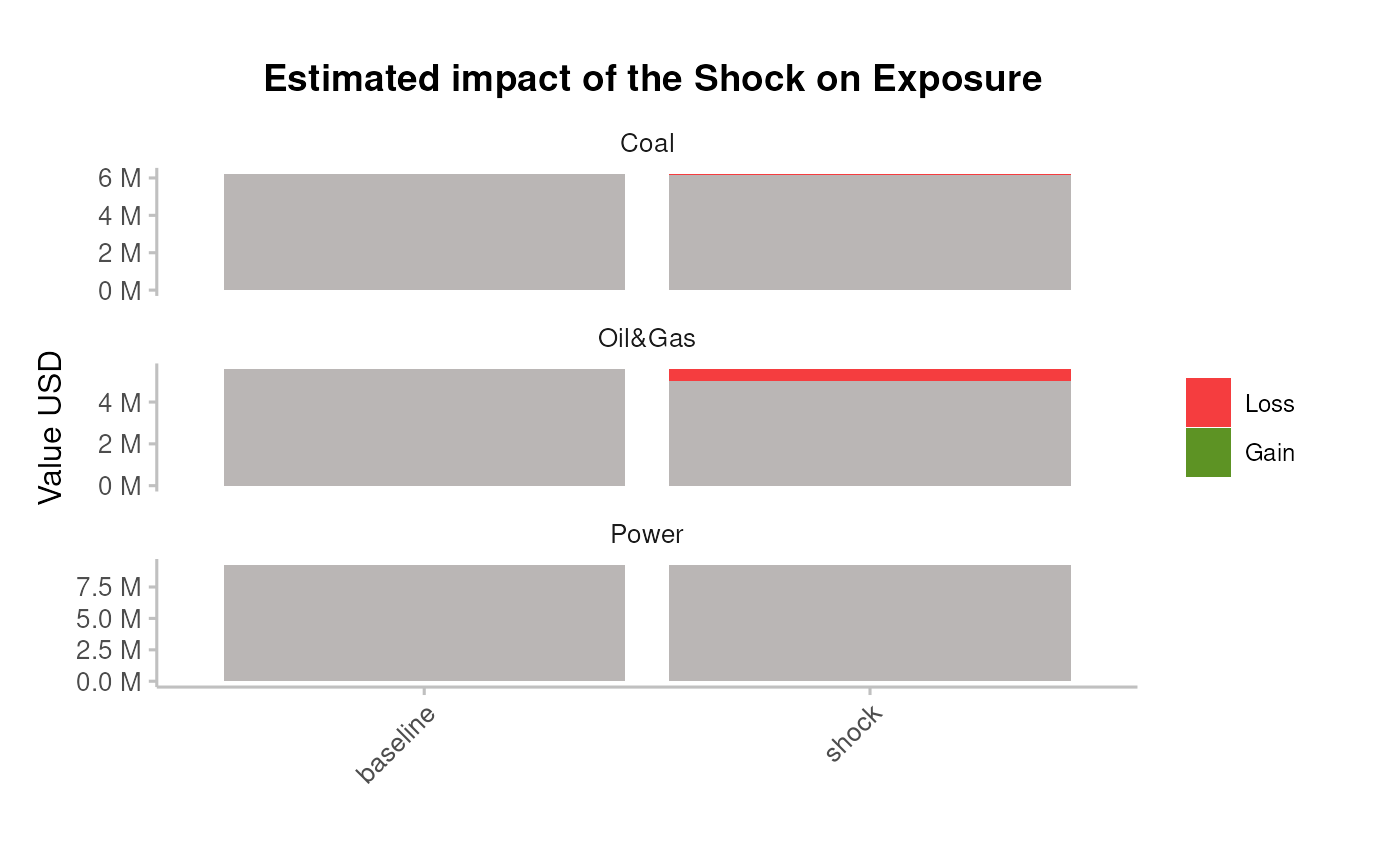

Plot the resulting portfolio’s exposure change

pipeline_crispy_exposure_change_plot(analysis_data)

#> Joining with `by = join_by(sector, technology)`

#> Warning: Removed 1 row containing missing values or values outside the scale range

#> (`geom_tile()`). ### Bonds&Loans risk

### Bonds&Loans risk

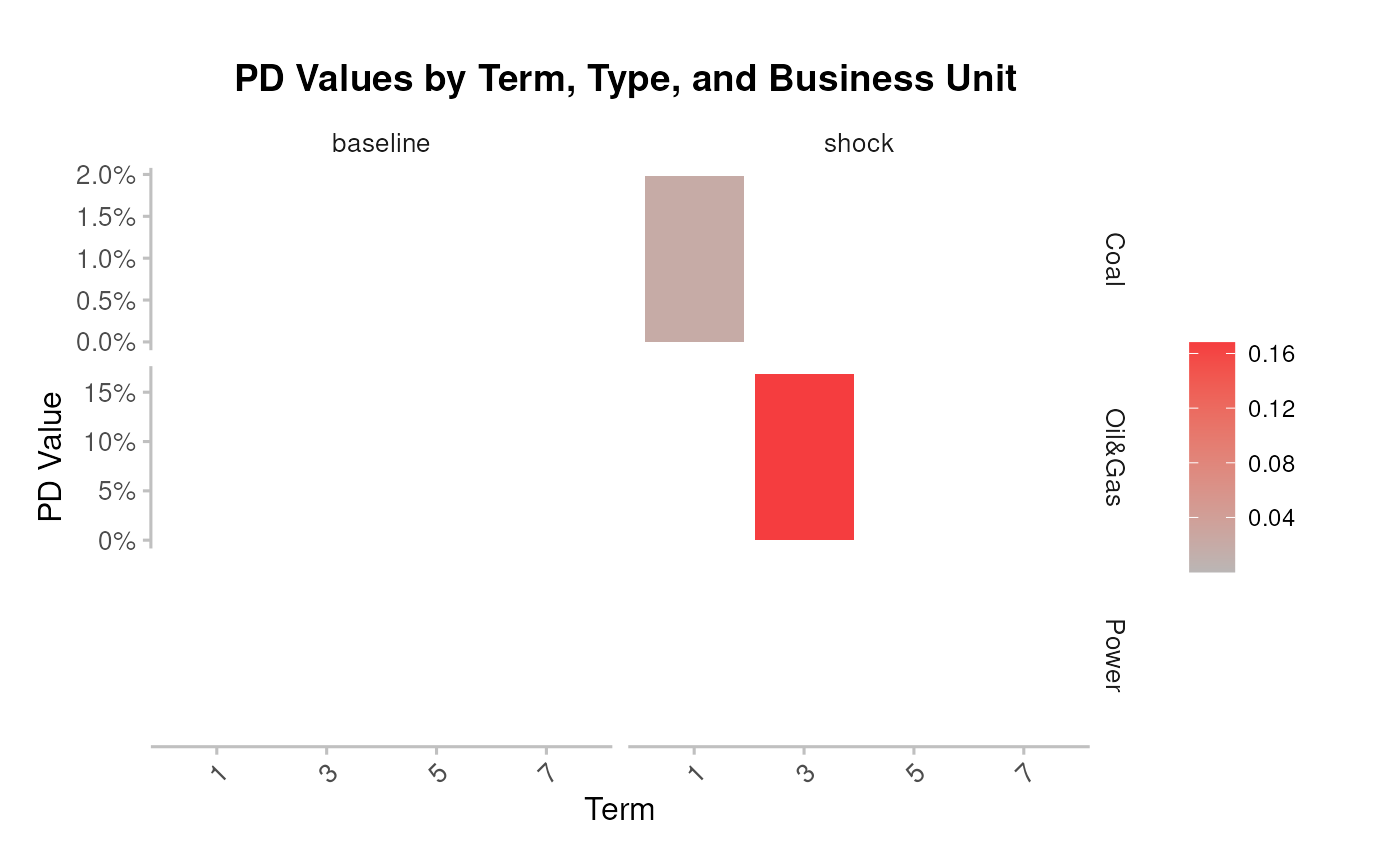

Plot the average PDs at baseline and shock

pipeline_crispy_pd_term_plot(analysis_data)

#> Joining with `by = join_by(sector, term)`

#> Warning: Removed 4 rows containing missing values or values outside the scale range

#> (`geom_bar()`).

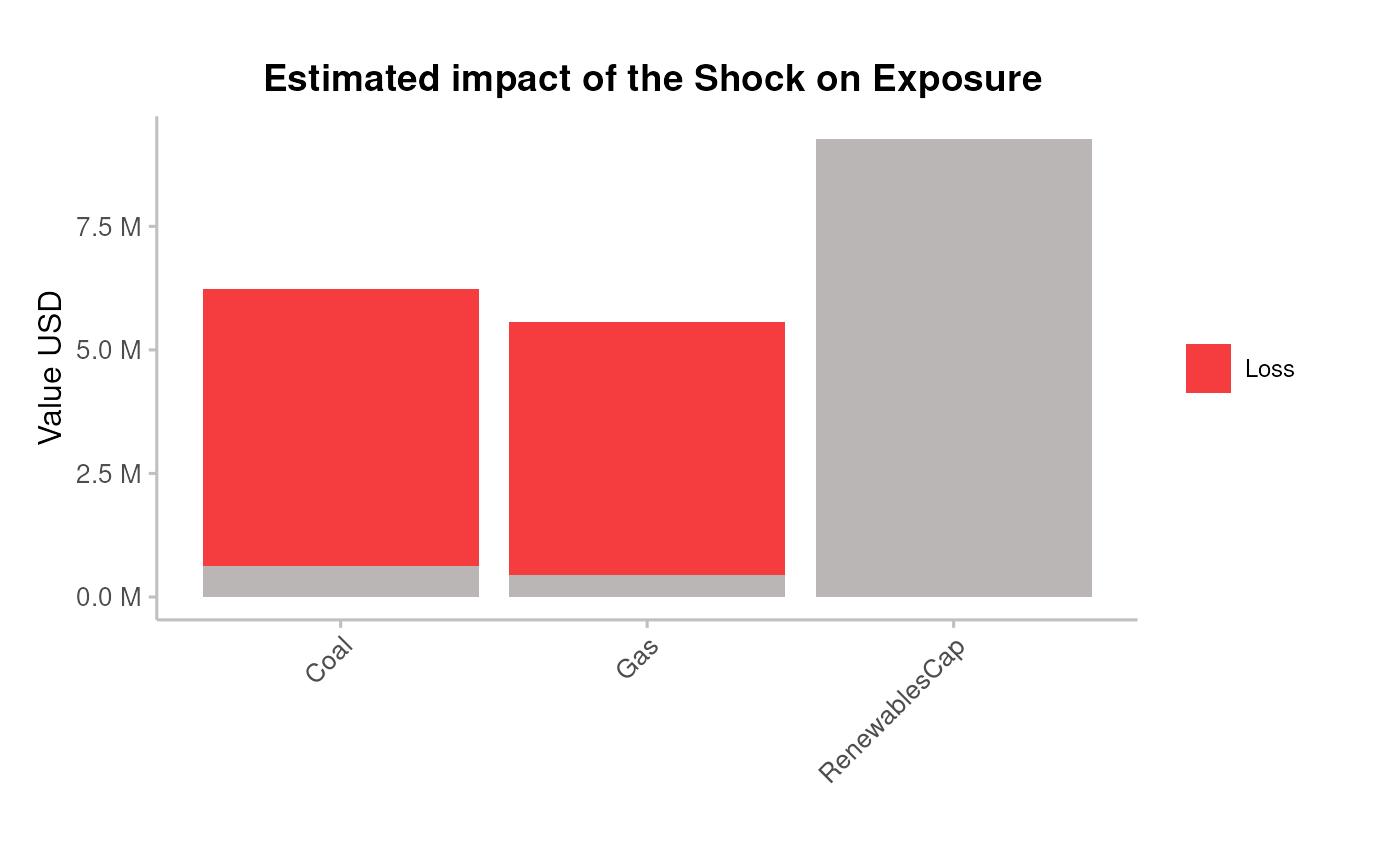

Plot the resulting portfolio’s expected loss

pipeline_crispy_expected_loss_plot(analysis_data)

#> Joining with `by = join_by(sector)`